Mammography Installations in the United States

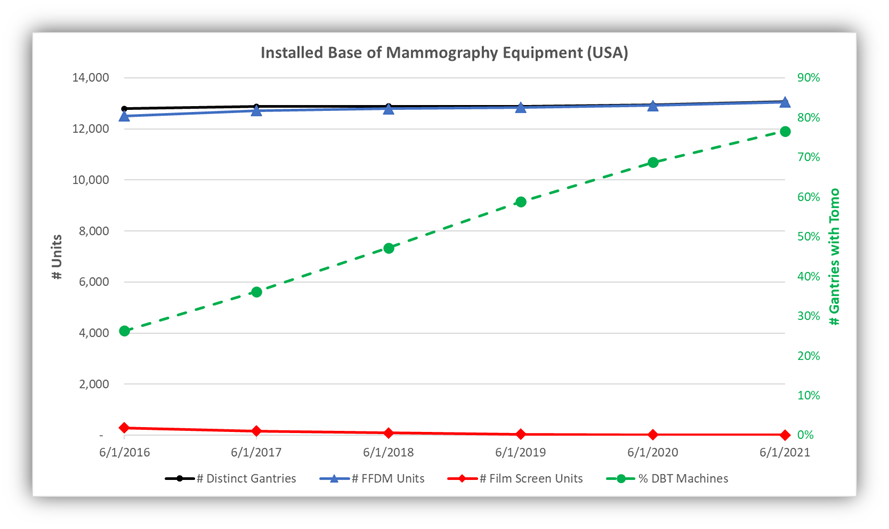

I thought my network might enjoy an update on installations of mammography equipment in the United States. I think we all remember how rapid the transition was from screen film mammography (SFM) equipment to full-field digital mammography (FFDM), driven both by a healthy reimbursement increase, the possibility of eliminating the labor and mess of screen film processing and chemistry, and by publication of the DMIST study[i]. It turns out that the transition to digital breast tomosynthesis (DBT) has been equally rapid, driven once again by improved reimbursement, as well as by improved visibility for radiologists and a lot of aggressive marketing by device manufacturers.

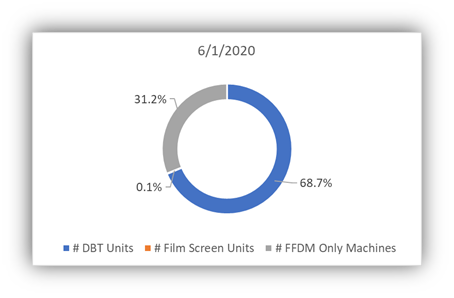

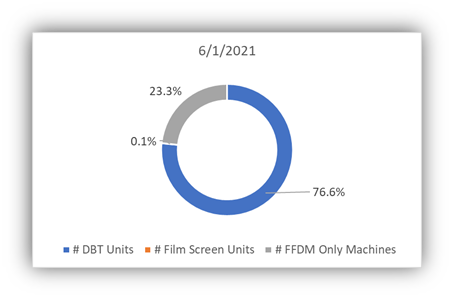

When you consider the number of devices that are capable of DBT imaging vs the number of devices that are not, you can see the rapid penetration of DBT in the marketplace (dashed green line), increasing from 26% in 2016 to 77% in 2021.

I find it very interesting that during the past 12 months, when the US was in the throes of the COVID-19 pandemic, the fraction of accredited DBT units continued to grow rapidly, although a slightly lower clip than the prior 12-month period (+7.9% vs +9.9%). One would imagine that sales of DBT units would have slowed during the last year due to more difficult access to clinical facilities because of COVID-19 restrictions. We will have to wait and see if there is a more appreciable lag – lower sales of DBT units in the last year resulting in a lower rate of DBT installations in the coming year.